2018 was a tough year for many investors, including me. I’m disappointed that my portfolio is down 4% for the year. While this is somewhat better than the wider stock market, it is a weaker performance relative to my benchmarks than I have achieved for the past few years. This leaves me looking for lessons to learn from and questioning whether there is anything about my strategy I should adjust.

I take some comfort from the fact that my weaker performance in 2018 appears mostly due to general concerns about macroeconomic factors rather than poor stock picks. These concerns, largely prompted by the Fed’s monetary policy and the trade war between the US and China, have affected the stock market in general and high quality growth stocks in particular. There have not been many issues specifically affecting the businesses I have invested in.

Looking back through some of my posts from last year, I think I was too dismissive of the macroeconomic concerns behind the stock market volatility. I don’t think I would have done anything drastically different, but probably I should have had greater respect for the stock market’s predictive ability. Much like a pet dog, it is prone to noisy overreactions but is nevertheless pretty good at sniffing out when there may be trouble coming round the corner.

The implications of China’s slowing growth for the world economy looks like it may become a major issue this year. I don’t know how this will play out, but Apple’s profit warning on Wednesday seems a rather ominous sign. Limiting my portfolio’s exposure to cyclical businesses and to companies with significant direct business in China seems like a sensible precautionary step. Beyond this, I don’t think it is a good idea to make any major adjustments to my strategy to account for macroeconomic concerns. It is simply too difficult to predict what will happen in the world economy, let alone how this will affect the stock market. It is all too easy to get the timing wrong. By and large I think it’s a better idea to ride out the waves of the business cycle and investor sentiment and instead focus on the relative prospects of specific investments.

Performance

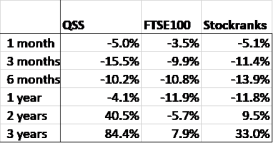

The performance of my portfolio (QSS) is shown against its benchmarks in the table below (all the figures below exclude dividends). My benchmarks as the FTSE 100 and a portfolio of the top decile of UK shares according to their Stockranks. The figures below do not include dividends.

The last three months have been poor. While the market as a whole has done badly, my portfolio has underperformed both the FTSE 100 and the top Stockrank stocks. This appears largely due to my exposure to US technology stocks, which have had a horrendous last quarter. I have some consolation in marginally outperforming the FTSE 100 and the top Stockrank stocks over the whole of 2018. Over the longer term I am comfortably ahead of these benchmarks.

My portfolio performed somewhat better than both my buy and hold and mechanical momentum benchmarks over the last quarter. I set up these benchmark portfolios to isolate the performance generated by different aspects of my strategy, as explained here. My portfolio has actually almost caught up with the mechanical momentum benchmark portfolio, largely due to a lesser exposure to US stocks, suggesting that it was indeed too early to read much into the momentum benchmark’s outperformance in the first half of the year.

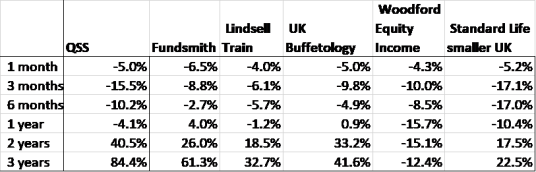

Last January I also benchmarked my portfolio against some of my favourite professional fund managers. I thought it would be worth revisiting this on a yearly basis, to keep an eye on whether these guys are outperforming me and if so what I might learn. The following table shows my performance against these other funds.

I was somewhat outperformed by Terry Smith’s Fundsmith, Nick Train’s UK equity fund and Keith Ashworth-Lord’s UK Buffettology fund. I lost the most ground during the last quarter and this appears largely due to their greater leaning towards defensive stocks. With the benefit of hindsight, it’s clear that I would have benefited from rotating towards more defensive stocks early last year. There was ample opportunity for this and plenty of warning signs. The eerily low volatility and relentless rises last January were a sign that a short term market top was developing. It was pretty likely that there would be more volatility to come following the correction in February. Given these signs, I should probably have been more cautious.

Interestingly, Neil Woodford’s predictions of impending stock market doom seem to maybe be coming to fruition, yet his performance for 2018 was again pretty dire. Just goes to show how difficult it is to successfully invest based on macroeconomic calls (even if you get them broadly right).

Individual shares

My worst trades last year were CBOE, Accesso Technology and Apple. My lesson from CBOE was not to let my conviction override a falling share price. My lesson from Accesso was to avoid excessive confidence in a highly valued business that is yet to demonstrate high profitability. I should have probably also sold more quickly as the share price started to tank.

I’m yet to write about Apple, which I sold on Thursday following its profit warning (my first in a while). The profit warning was driven predominantly by weak iPhone sales in China. I was very confident when I bought Apple – it has obvious high quality, looked very cheap and to cap it off was being bought by the bucketload by Warren Buffett. Unfortunately, this resulted in high conviction and me holding on to my shares for longer than was warranted. It appears that the market’s concerns about slowing iPhone sales were well-founded. My lesson here (again) is to avoid excessive conviction in the face of a falling share price.

Strategy review

Momentum vs valuation

My strategy is based on behavioural / ‘factor-investing’ principles. I only invest in what I think are the highest quality businesses, as I believe the stock market consistently undervalues them. I then use momentum and relative valuations to decide which of these high quality businesses belong in my portfolio at any given time. I’m confident that my focus on quality works well, but I’ve found it more of a challenge to confidently and systematically exploit momentum and relative valuations.

I prefer to base my investment decisions primarily on momentum. It is straightforward to implement, there are strong behavioural reasons why it should work and loads of empirical evidence that it does work most of the time. The issue I’ve been grappling with recently is whether there are times when I should abandon momentum and simply hunt for bargains instead. In a market panic it can feel particularly foolish to sell out of a stock that has fallen steeply for no apparent reason, only to buy into one that has fallen less. This kind of trading decision makes me imagine Warren Buffett looking over my shoulder, shaking his head and walking away in disgust. Surely it would be more rational to buy into the cheapest stocks that have fallen the most in the panic?

The answer is less straightforward than it may seem. How long is the correction going to last? Is a bigger price fall actually due to worsening relative prospects or because the stock was relatively overvalued before? I’m coming to the view that ‘bottom-fishing’ for bargains requires a level of conviction and patience that just doesn’t fit with the rest of my strategy. I will take relative valuations into account but only when I’ve also got momentum onside.

Trading discipline

The most significant change to my strategy last year was to move away from using stop losses to a system of periodic rotation, where I make no more than one trade every couple of weeks (normally swapping a weaker momentum share for a stronger one). I felt that stop losses were leading me to overtrade and harming my performance in a volatile market. Even though this change may have cost me a little in the short term, as I decided to make it shortly before the market corrected in October, I am happy it. I think it’s likely to achieve a better balance between targeting momentum while not overreacting to short term volatility. Also, by forcing myself to delay trading decisions I’ve ended up thinking them through more carefully. Hopefully over time this should mean I make better decisions.

Enjoyed article and hope you get time to do a a few personal trading articles outside IC. Good luck for 2019.

LikeLike